W-2 reporting for health coverage is a crucial aspect of tax compliance that both employers and employees need to understand. The Internal Revenue Service (IRS) requires employers to report the cost of health coverage provided to their employees on Form W-2. To simplify this process, many businesses use a W-2 generator. This reporting helps individuals track their health benefits and ensures transparency in tax reporting. In this guide, we’ll explore the essentials of W-2 reporting for health coverage, including its purpose, what is reported, and compliance requirements.

Purpose of W-2 Reporting

The primary purpose of W-2 reporting for health coverage is to provide employees with a clear understanding of the value of the health benefits they receive from their employers. This information is valuable for employees when they assess their total compensation packages and make informed decisions about their healthcare plans. Additionally, the IRS uses this data to monitor compliance with the Affordable Care Act (ACA) and other tax regulations.

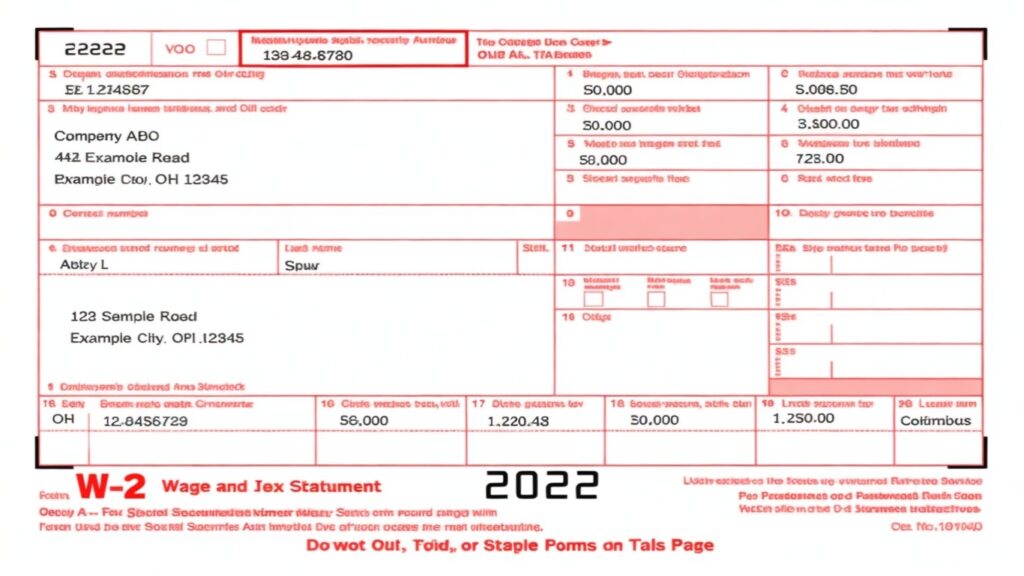

What Is Reported on Form W-2?

On Form W-2, employers are required to report the total cost of health coverage provided to each employee during the tax year. This cost includes both the employer and employee contributions to health insurance premiums, as well as the cost of any other health-related benefits, such as health savings accounts (HSAs) or flexible spending accounts (FSAs). The reporting is done in Box 12, using a specific code (Code DD) to distinguish it from other types of income.

Compliance Requirements

Employers must adhere to specific compliance requirements when reporting health coverage on Form W-2. Here are some key considerations:

- Reporting Threshold: Employers that filed 250 or more W-2 forms for the previous tax year are required to report the cost of health coverage. However, smaller employers can voluntarily provide this information if they choose to do so.

- Accurate Reporting: Employers must ensure the accuracy of the information reported on Form W-2. Errors can lead to penalties and may result in employee confusion.

- Exclusions: Some types of health coverage are excluded from reporting, such as long-term care benefits, dental or vision plans that are not integrated with a health plan, and certain wellness program benefits.

- Forms Distribution: Employers must provide employees with their W-2 forms by the January 31st deadline, allowing employees to file their income tax returns accurately.

Employee Impact and Tax Considerations

Understanding the information reported on Form W-2 for health coverage is essential for employees. It can impact their tax liability and benefits eligibility:

Taxable vs. Non-Taxable Benefits

Generally, the cost of health coverage reported on Form W-2 is informational and does not make health benefits taxable. However, it helps the IRS track compliance with the ACA’s individual mandate.

Premium Tax Credit

Individuals who purchase health coverage through the Health Insurance Marketplace may be eligible for the Premium Tax Credit. The information on Form W-2 helps determine eligibility and the amount of the credit.

Reporting Discrepancies

Employees should review their Form W-2 to ensure accuracy. Any discrepancies should be addressed with their employer to avoid issues with their tax return.

In conclusion, W-2 reporting for health coverage is a vital component of tax compliance that benefits both employers and employees. It provides transparency in compensation packages and assists the IRS in enforcing tax regulations. Employers must ensure accurate reporting, and employees should be aware of the information on their W-2 forms to make informed tax-related decisions. Staying informed about W-2 reporting for health coverage is essential for a smooth tax filing process and financial planning.